In recent years, India has seen a significant rise in its production levels, aided by a whopping $4 billion of foreign direct investment (FDI) inflows. These inflows have played a pivotal role in boosting the country’s economy, and a noteworthy 70% of this FDI has gone to beneficiaries of the Production-Linked Incentive (PLI) scheme. This is a clear indication of the success and impact that the PLI scheme has had on the Indian manufacturing sector.

The Department for Promotion of Industry and Internal Trade (DPIIT) recently released the data on FDI inflows for the financial year 2020-21. The figures show that India received a total FDI inflow of $81.72 billion, which is a 10% increase from the previous financial year. Out of this, $4 billion was directed towards the manufacturing sector, which is a significant jump from the $2.33 billion recorded in the previous financial year.

This rise in production and FDI inflows is a result of the government’s continuous efforts to make India a global manufacturing hub. The PLI scheme, launched in April 2020, is one of the key initiatives taken by the government to attract investments and boost production in various sectors. Under this scheme, eligible companies are provided financial incentives for manufacturing goods in India, thereby increasing their competitiveness in the global market.

The success of the PLI scheme can be traced back to the various measures taken by the government to improve the ease of doing business in India. The introduction of the single-window clearance system, simplification of licensing and registration procedures, and the implementation of GST have all contributed to creating a more favorable business environment. This has instilled confidence in foreign investors, resulting in the significant increase in FDI inflows.

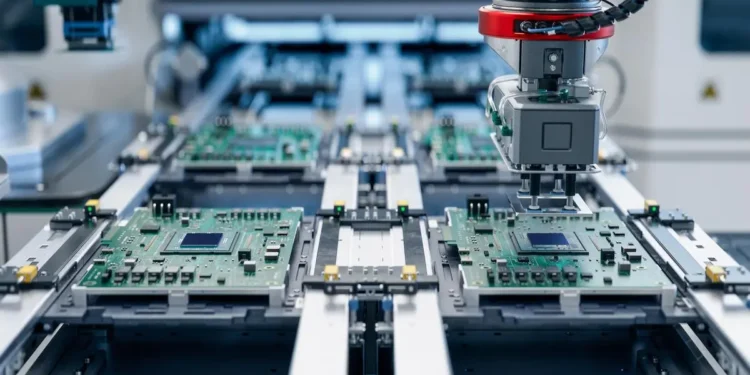

The PLI scheme has been instrumental in attracting investments from some of the biggest names in the industry, including Samsung, Apple, and Foxconn. These companies have pledged to manufacture smartphones, medical devices, and other electronic goods in India, which will not only boost production but also create employment opportunities for the country’s youth. With more investments pouring in, the manufacturing sector is expected to witness an exponential growth in the coming years.

Apart from the PLI scheme, the government has also taken several other measures to promote manufacturing and increase production. The introduction of sector-specific policies and schemes, such as the National Policy on Electronics, National Capital Goods Policy, and the recently launched Atmanirbhar Bharat Abhiyan, have provided a much-needed impetus to the Make in India initiative.

The rise in production levels and FDI inflows has not only strengthened the Indian economy but also improved its position in the global market. India has now become the second-largest manufacturer of mobile phones in the world, and several other sectors, such as pharmaceuticals, textile, and automotive, have also witnessed significant growth. This has also resulted in a reduction in the country’s import bill, making it more self-reliant and less dependent on other countries for meeting its domestic demands.

The increase in FDI inflows also reflects the growing confidence of foreign investors in the Indian economy, especially during the challenging times of the COVID-19 pandemic. While several countries saw a decline in FDI inflows, India managed to attract a record amount, which is a testament to the country’s resilience and potential.

In conclusion, the rise in production levels aided by $4 billion of FDI inflows, with 70% of it directed towards beneficiaries of the PLI scheme, is a remarkable achievement for India. This demonstrates the success of the government’s initiatives in promoting manufacturing and attracting investments, and it also marks a significant milestone in the country’s journey towards becoming a global manufacturing hub. With the government’s continued efforts and support, India is poised to witness even greater heights in terms of production, making it an attractive investment destination for the rest of the world.